By Adeyemi Adekunle

The Lagos State Government is advocating for significant reforms in the tax collection process in a move towards achieving Nigeria’s ambitious goal of a $1 trillion economy by 2030.

This urgent call comes amidst ongoing discussions in the National Assembly regarding a new tax bill intended to overhaul the current tax framework in Nigeria.

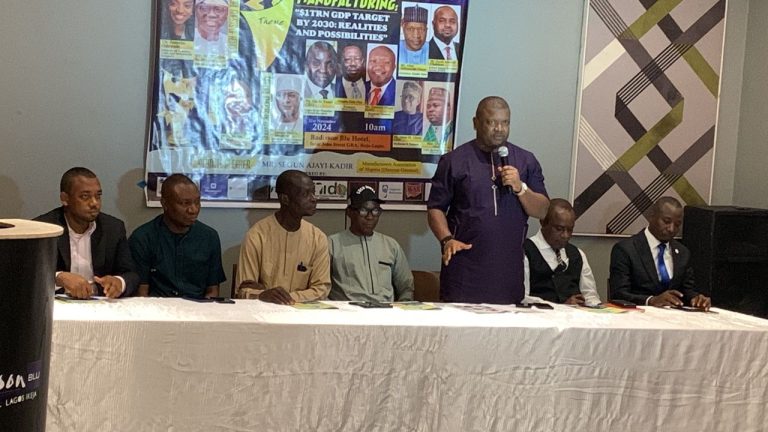

At the 2024 Annual Workshop and Awards of the Commerce and Industry Correspondents Association of Nigeria (CICAN), Mrs. Bukola Odoe, Special Adviser on Public Private Partnerships to the Lagos State Government, highlighted the integral role of optimized tax collection in driving sustainable economic growth.

Represented by Mr. Adefisoye Adekunle, a Consultant and Financial Analyst, Odoe asserted that a more efficient tax system is essential for increasing revenue generation and fostering equitable economic development.

“We need to focus and optimize our collection process, make it simpler, and make it easier,” Odoe stated, emphasizing that a user-friendly tax payment system accessible via smartphones could alleviate the burdens faced by many taxpayers.

Her remarks underscore a modern approach to tax administration, wherein technology plays a central role in enhancing compliance and streamlining processes.

Odoe further articulated the significance of fiscal policy in the context of national development, making the case that sustainable revenue generation is crucial for progress. She pointed out that states lacking control over oil revenue, like Lagos, must maximize non-oil tax collections through prudent financial management to benefit their citizens and invigorate local economies.

One striking aspect of Odoe’s presentation was her support for legislative efforts aimed at modernizing tax laws. She highlighted the potential benefits of integrating technology into the tax administration process, which she believes could help simplify tax compliance and expand the tax base.

“The anticipated amendment of the current VAT Acts is in alignment with the proposed bill,” she added, reinforcing the alignment between legislative reform and economic growth objectives.

However, while the Lagos State Government is optimistic about tax reforms, concerns over the challenges facing Nigeria’s private sector loomed large during the event.

Mr. Charles Okonji, the National Chairman of CICAN, expressed grave concerns regarding the declining health of the private sector. “The repercussions are evident, with many multinational corporations relocating to neighboring countries due to unfavorable business conditions,” Okonji lamented, underscoring the urgency for strategic interventions.

In his address, Okonji emphasized the critical role of a robust private sector in driving Nigeria’s economic growth, reflecting on how innovation and production are vital for the country’s global competitiveness. He warned that without rejuvenation of the private sector, Nigeria could risk falling behind in a rapidly evolving global market.

The theme of the workshop—“Manufacturing: $1 trillion GDP target by 2030: Realities & Possibilities”—echoed the multifaceted challenges confronting Nigeria’s manufacturing industry. Okonji acknowledged that while the GDP target is ambitious, concerns regarding persistent governmental shifts and the lack of sustained policies could hinder meaningful progress.

“Intermittent changes in government leadership could impede progress toward achieving such a significant economic milestone,” he remarked, pointing to the need for stable and enduring policies.

Despite these challenges, there remained a sense of optimism among stakeholders present at the workshop. The collective expertise in the room was seen as a beacon of hope, fostering a commitment to navigate the complexities surrounding Nigeria’s manufacturing sector. Okonji highlighted the importance of collaboration among industry players to voice their needs and advocate for policies that can nurture local businesses.

“There is a need for unity among key industry players,” Okonji stated. “By involving stakeholders and leveraging their collective voices to influence government decisions, we can shape policies that support local businesses and contribute to the overall sustainability of the manufacturing sector in Nigeria.”

Economic analysts believe that the synergies created through stakeholder engagement, backed by technology-driven reforms, could be the catalyst required to transform Nigeria’s economic landscape.

With the Federal Government also named in the conversation, an inclusive dialogue around fiscal policy reforms is seen as necessary for galvanizing support and driving cohesive actions across various sectors of the economy.

As the dialogue around tax reforms progresses, the Lagos State Government’s emphasis on optimization, integration of technology, and enhanced compliance may offer a crucial template for revitalizing the tax collection process.

The outcome of these discussions could significantly shape not only Lagos but also Nigeria’s path towards realizing its economic aspirations.

The stakes are high, as the actions taken today will either harness the potential of the private sector or leave it struggling in the shadows. Essentially, the future of Nigeria’s economy depends on decisive action; nurturing innovation, and embracing change are not just options but necessities.

It remains to be seen how these discussions will unfold in the corridors of power and whether the proposed reforms will gain the traction needed to ensure that Nigeria can meet its $1 trillion economy target by 2030.

The commitment expressed by leaders at the CICAN workshop highlights a shared dedication to pursue strategies that enhance revenue, promote fiscal responsibility, and ultimately, lay the groundwork for a more prosperous economic future for Nigeria. As stakeholders rally together, the focus now shifts to action—transforming these ideas into tangible policies that benefit all Nigerians.