By Adeyemi Adekunle

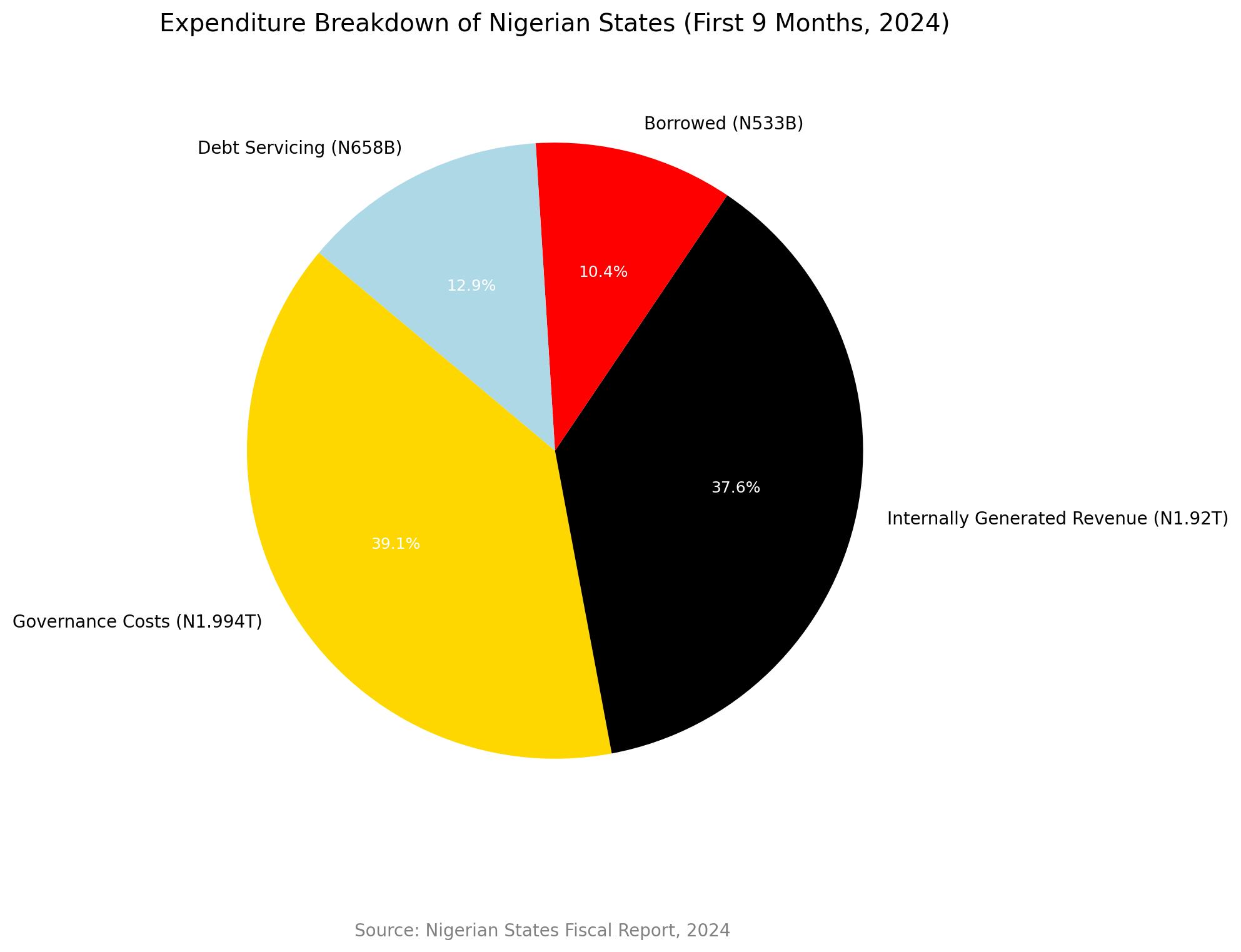

Abuja, Nigeria– Twenty-nine Nigerian states collectively spent a staggering N1.994 trillion on governance costs in the first nine months of 2024, raising concerns about fiscal discipline and sustainable economic management, according to a newly released report.

The expenditures, classified as recurrent, included allowances, travel, utilities, and other overheads, underscoring the mounting cost of maintaining governance structures. Despite an improved inflow of funds from the Federation Account, the report revealed that the states fell short of their internally generated revenue (IGR) targets, collectively raising N1.92 trillion.

Adding to the fiscal strain, these states borrowed a total of N533 billion within the same period while spending N658 billion to service existing debts. Analysts warn that this pattern of borrowing to finance recurrent expenses risks plunging the states into unsustainable debt cycles.

Among the 29 states analyzed, Lagos and Delta recorded the highest recurrent expenditures. Lagos, known for its vast economic activity and revenue generation capacity, has long maintained significant overhead costs. Delta, on the other hand, highlighted the financial pressures tied to oil-producing states, where allocations often fail to meet rising governance demands.

Conversely, states like Niger and Katsina topped the borrowing chart, indicating heightened financial challenges. Their borrowing underscores an increasing dependency on external funds to sustain operations, raising questions about their fiscal management strategies.

The report’s revelation of N658 billion spent on debt servicing alone signals an alarming trend, with a significant portion of state revenues diverted toward managing past financial obligations rather than developmental projects. Fiscal analysts have raised concerns over this trajectory, warning that it limits states’ capacity to invest in infrastructure and human capital development.

With recurrent expenditures nearly double the IGR figures, experts are calling for immediate reforms to reduce the cost of governance. “The data exposes a glaring lack of fiscal discipline in many states. It’s time for governments to prioritize efficiency and channel resources toward productive sectors,” a public finance expert stated.

While improved Federation Account allocations have provided temporary relief, they have failed to bridge the gap between expenditure and revenue. This underscores the need for states to diversify their economies and boost IGR without over-relying on federal transfers or unsustainable loans.

The report paints a concerning picture of Nigeria’s subnational fiscal health, with recurrent expenditures and debt obligations threatening to overshadow developmental priorities.

As 2024 draws to a close, many are urging state governments to adopt stricter fiscal measures and cut governance costs to avert potential financial crises.